May 15, 2024

Building Your Financial Model: Get Your Financial Profile Ready!

Knowing who will lend to your group, it is now time to compile your financial profile and get yourself and your group ready to approach lenders. While intimidating, being prepared and meticulous in your profiles is key. It’s always better to have more than less.

How Will You Buy As A Group?

Understanding the assets you have to work with as a group is key. Collectively, your group will have:

- equity to make a down payment

- income to pay the mortgage, taxes, utilities and expenses

- debt that needs to be accounted for in the group’s finances

Your Financial Checklist

Your lenders will look at the financial health of each individual situation, and then the group as a whole. To prepare for this, each person in your group must do some work:

- Check your credit score. If it needs work (below 680), start the work to improve it.

- Ensure your taxes are up to date and paid.

- Do a budget.

- Determine how much you can contribute in cash and equity to the down payment and closing costs.

- Determine your maximum monthly contribution towards your mortgage payment, property taxes and other expenses.

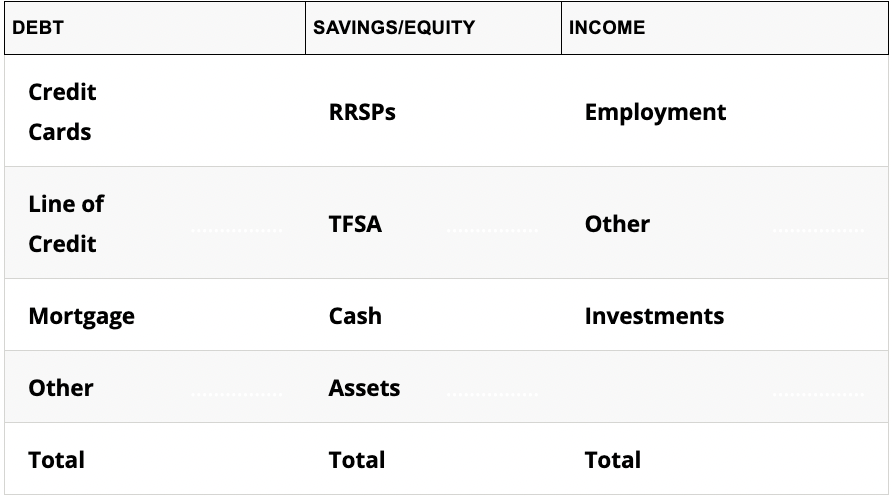

To help you understand your financial profile, fill in the table below. Every member of your group should fill their own individual profiles out.

Then Review as a Group:

- Combine the histories and budgets into a group budget

- Determine your group’s total available funds for a down payment and closing costs.

- Determine your groups’ income for total monthly mortgage payments

Once you have completed your individual financial picture, combine your debt, savings and income information to create this snapshot of your group’s collective finances:

How Do You Build Your Financial Model?

Click on the sections below to learn more.

- Building Your Financial Model: Introduction

- Building Your Financial Model: What's In A Mortgage?

- Building Your Financial Model: Who Will Lend To You?

- Building Your Financial Model: Get Your Financial Profile Ready!

- Building Your Financial Model: Creating Your Budget

- Building Your Financial Model: Combine-Leverage-Split

- Building Your Financial Model: Summary & Next Steps