Building Your Financial Model: Creating Your Budget

Budgets and finances can be confusing and complicated. Not to mention it can get very stressful when comparing your answers to your group.

To help you out, we’ve created an example of how to create a budget and financial profile for your group so that you’re able to create your own group budget.

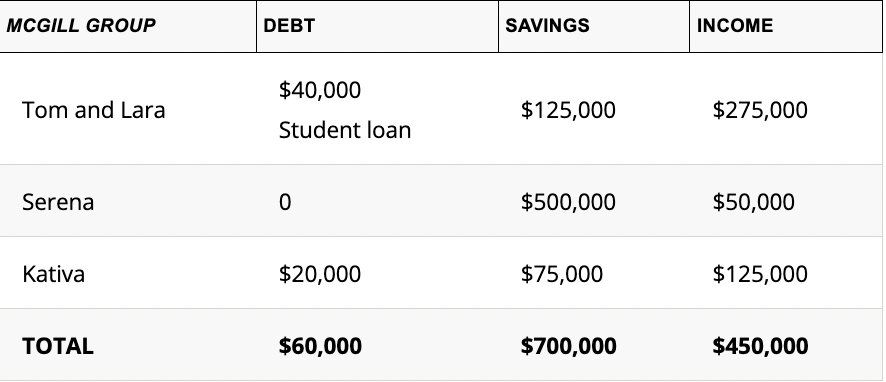

The McGill Group Example

Let’s call this group the “McGill” group, because they all met at McGill University.

They are: Tom, Lara, Serena and Kativa.

Tom and Lara are married and have 1 child. Serena and Kativa are both single women. Serena is Lara’s sister and uses a wheelchair. All adults have full time jobs.

The McGill group is in a good position. They can likely afford a home that costs more than $2 million dollars, and they also need to factor in the cost of potential renovations to make their house wheelchair accessible.

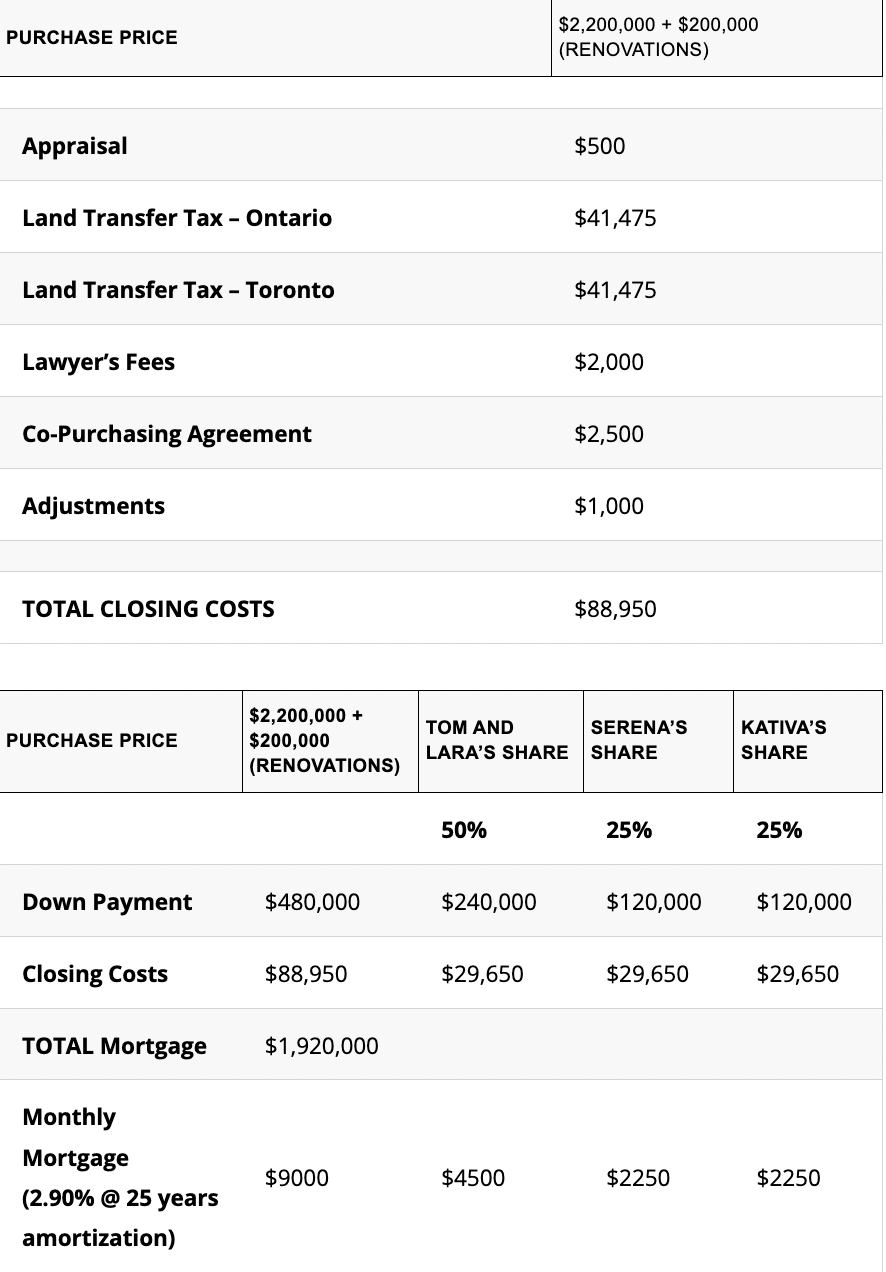

Using an estimate of a home at a price of $2,200,000 with an additional $200,000 budgeted for renovations, here is the McGill group’s estimated closing costs and budget:

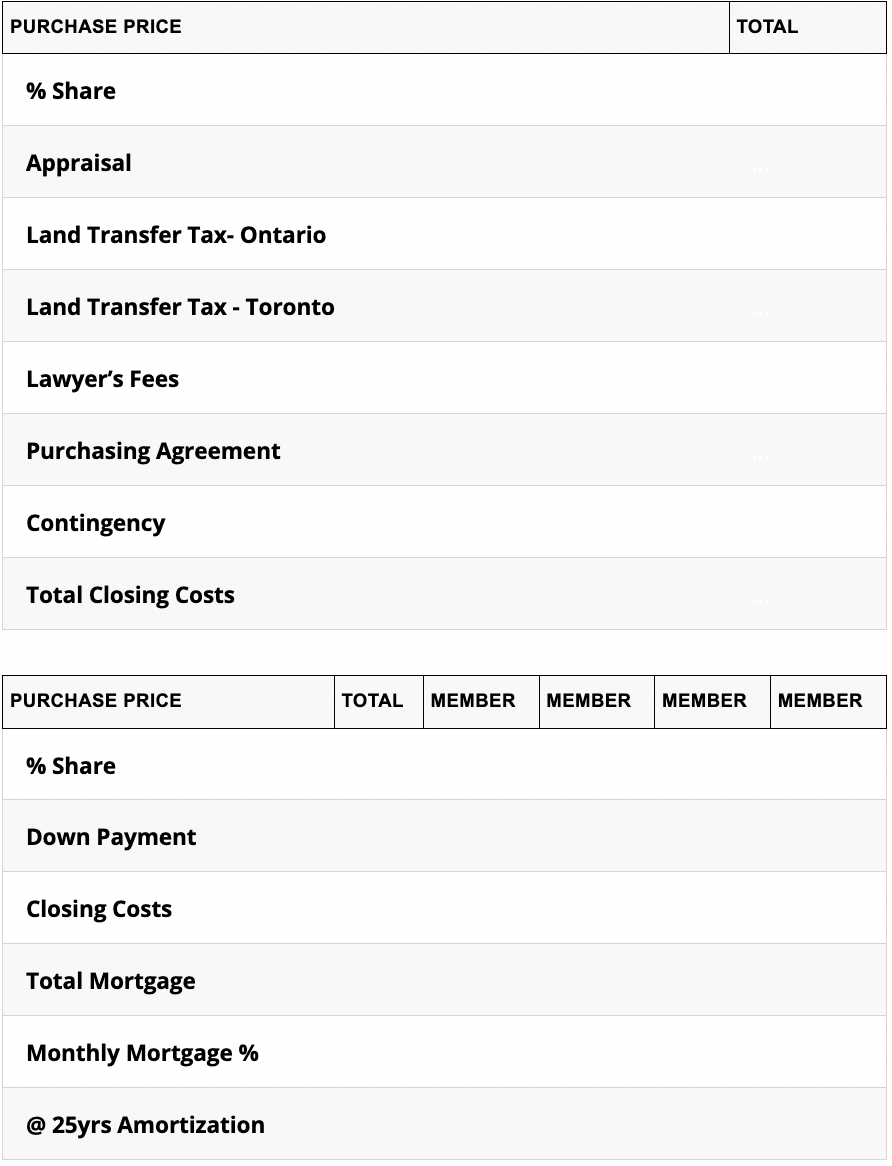

Now It’s Your Turn:

From your group finances snapshot, you can determine your group’s total available funds for a down payment and closing costs, and your total monthly income for mortgage payments and expenses. Working backwards from this information, create a draft purchasing budget below, mapping out the share of each member in your group. Refer to the McGill Group’s budget and closing costs estimate as an example.

How Do You Build Your Financial Model?

Click on the sections below to learn more.

- Building Your Financial Model: Introduction

- Building Your Financial Model: What's In A Mortgage?

- Building Your Financial Model: Who Will Lend To You?

- Building Your Financial Model: Get Your Financial Profile Ready!

- Building Your Financial Model: Creating Your Budget

- Building Your Financial Model: Combine-Leverage-Split

- Building Your Financial Model: Summary & Next Steps