Get Started with Co-Ownership

Why Are You Considering Co-ownership?

You are here because you see an opportunity in co-ownership. You may consider co-ownership as a way of entering the housing market, or like the idea of having a community by your side sharing the ups and downs of life.

As you get started, it is important to identify and prioritize the reasons why you are considering sharing ownership of a home and what benefits it could bring you. This will help you design a solution that best meets your needs.

Know your Needs and Wants

You can start thinking about your specific needs and wants when looking for a property once you have clarified your reasons for considering co-ownership. This is critical in helping you find the right co-ownership partner, as you want to make sure that your partner is someone who shares your vision and approach to owning a property. Knowing your needs and wants will also be helpful when searching for properties alongside your real estate agent and builder.

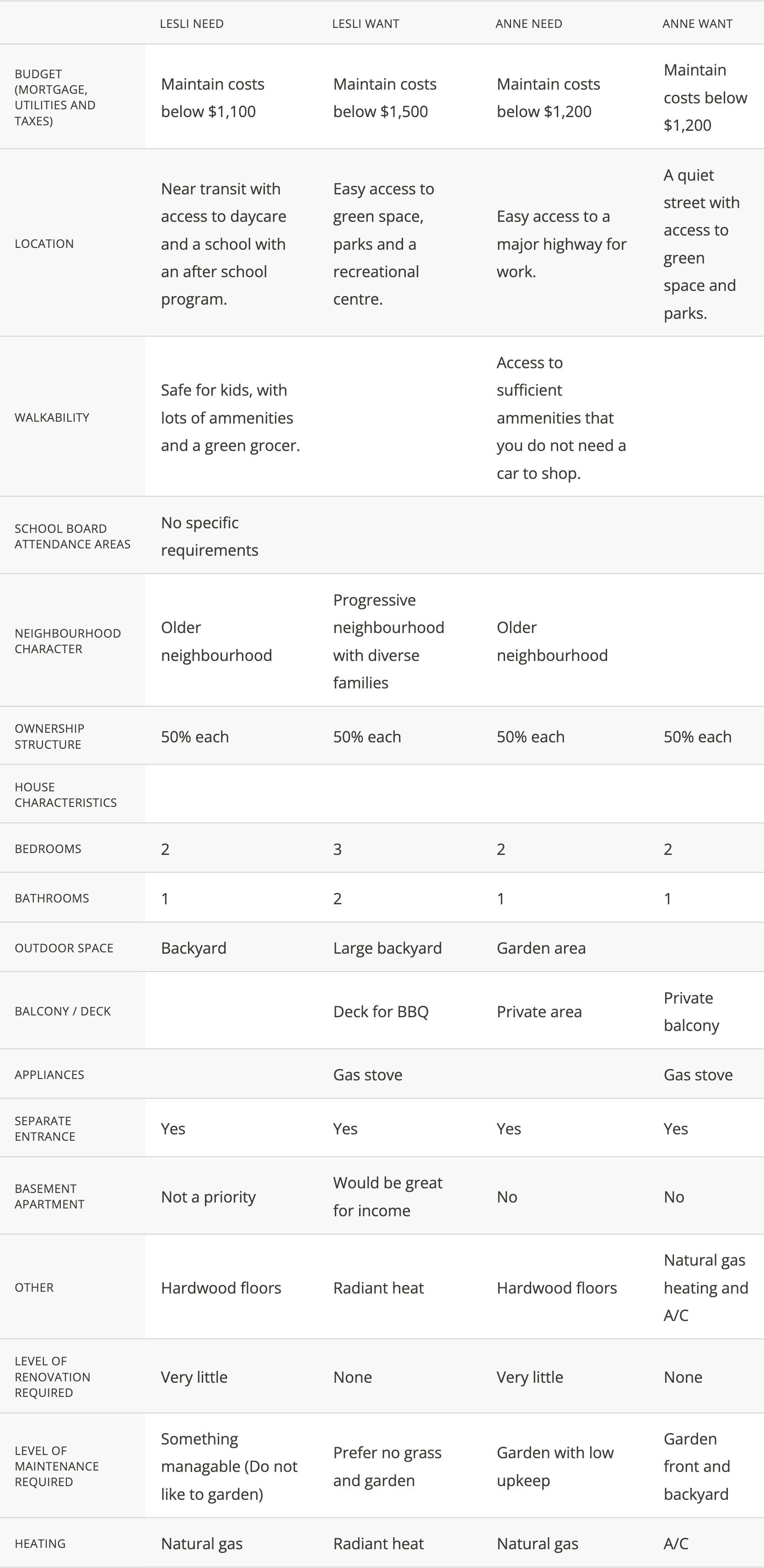

Download the Husmates Needs and Wants List, it will help you clarify what you need and want in a property, and whether you and your co-ownership partners are compatible.

Once you've clarified your needs and wants, you can skip ahead to finding like-minded partners who share your vision for co-ownership. Connecting with the right partners is crucial for a successful journey.

Case Study: Lesli Gaynor, Husmates Co-Founder and Co-owner

I bought my first house with my good friend Anne years ago and I still remember what drove this decision. I was a single mother with a relatively limited income and was a renter. I wanted the security of owning, but I knew that I couldn’t afford anything on my own.

It was over a weekend away that my friend Anne and I discussed the idea of buying something together. We didn’t know if it was even possible, and there was very little information available. It was by luck we found a real estate agent that believed we could secure a property and a credit union that would lend us money.

At the time, we did not give much consideration to a legal agreement but luckily all went well. After a number of years we sold that property and were both able to purchase properties independently. Although the real estate market was easier to get into in 1990, co-purchasing was the only way for us to step onto the property ladder.

I believe that today’s market requires us to think creatively and to pool our resources to live better lives. Thinking differently about ownership can help us establish financial, well-being and social supports.

In my opinion, the value of building relationships and community, having others around to help look after your kids, walk the dog, carry heavy loads, shovel the drive or just to say hello is worth much more than any perceived inconvenience of co-ownership.

Lesli & Anne's Initial Needs & Wants List

Understand Your Current Situation and What You Need to move Forward

Now that you know why you are interested in co-ownership, what you want and need, and the different types of agreements you are open to, you need to understand your current situation as a foundation for building a path of where you want to go.

The first step is to understand your financial situation. Answer questions like,

- How much down payment do you have?

- How much could you afford for a mortgage, utilities and maintenance on a monthly basis?

A good place to start is with your rental payments today. You are likely already paying a monthly sum for housing. Knowing that you can afford at least that amount in mortgage and expenses is a great place to start. You can then estimate numbers for your potential co-owner to gauge how much you could afford together.

For those eager to explore co-ownership further, delve into the other sections of our Co-Ownership Beginner Guide: