Creating Your Legal Agreement: Defining Financial Obligations

Creating a clear and comprehensive Legal Agreement is crucial for successful co-ownership. One key component of this agreement should be a detailed schedule for mortgage payments and a clear delineation of other financial obligations, such as bills and taxes.

The Importance of Financial Clarity

By signing the Legal Agreement, all members of your purchasing group commit to meeting their financial responsibilities. As today's lenders do not recognize fractional mortgages, your group must collectively ensure all financial obligations are met. If the mortgage defaults due to non-payment by one member, it can negatively impact the credit scores and future borrowing capabilities of all members.

Key Elements to Include

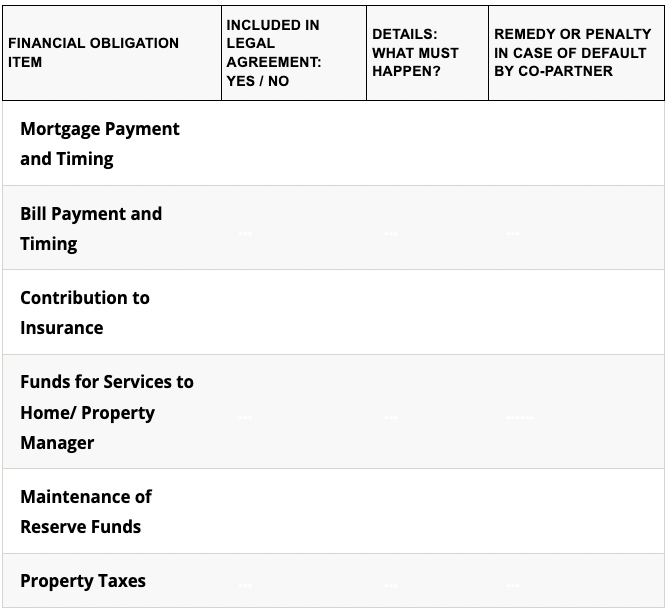

Mortgage Payment Schedule: Clearly outline the required schedule for mortgage payments in your Legal Agreement. This ensures everyone knows their payment responsibilities and deadlines, helping to prevent any misunderstandings or missed payments.

Additional Financial Commitments: Decide what other financial commitments from your Group Agreement you want to include in your Legal Agreement. This could include utilities, maintenance costs, property taxes, and any other shared expenses. Being specific about these obligations will help maintain transparency and fairness within the group.

Final Thoughts

Establishing a solid Legal Agreement with well-defined financial obligations is essential for protecting your investment and fostering a cooperative co-ownership experience. By addressing these details upfront, your group can focus on building a successful and harmonious shared home.

The next part will cover Future Scenarios!

How Do You Create Your Legal Agreement?

Click on the sections below to learn more.

- Creating Your Legal Agreement: An Introduction

- Creating Your Legal Agreement: Understanding Joint Tenancy and Tenants-in-Common

- Creating Your Legal Agreement: Rights and Responsibilities

- Creating Your Legal Agreement: Defining Financial Obligations

- Creating Your Legal Agreement: Planning for Future Scenarios

- Creating Your Legal Agreement: Essential Legal Steps and FAQs